Table of Content

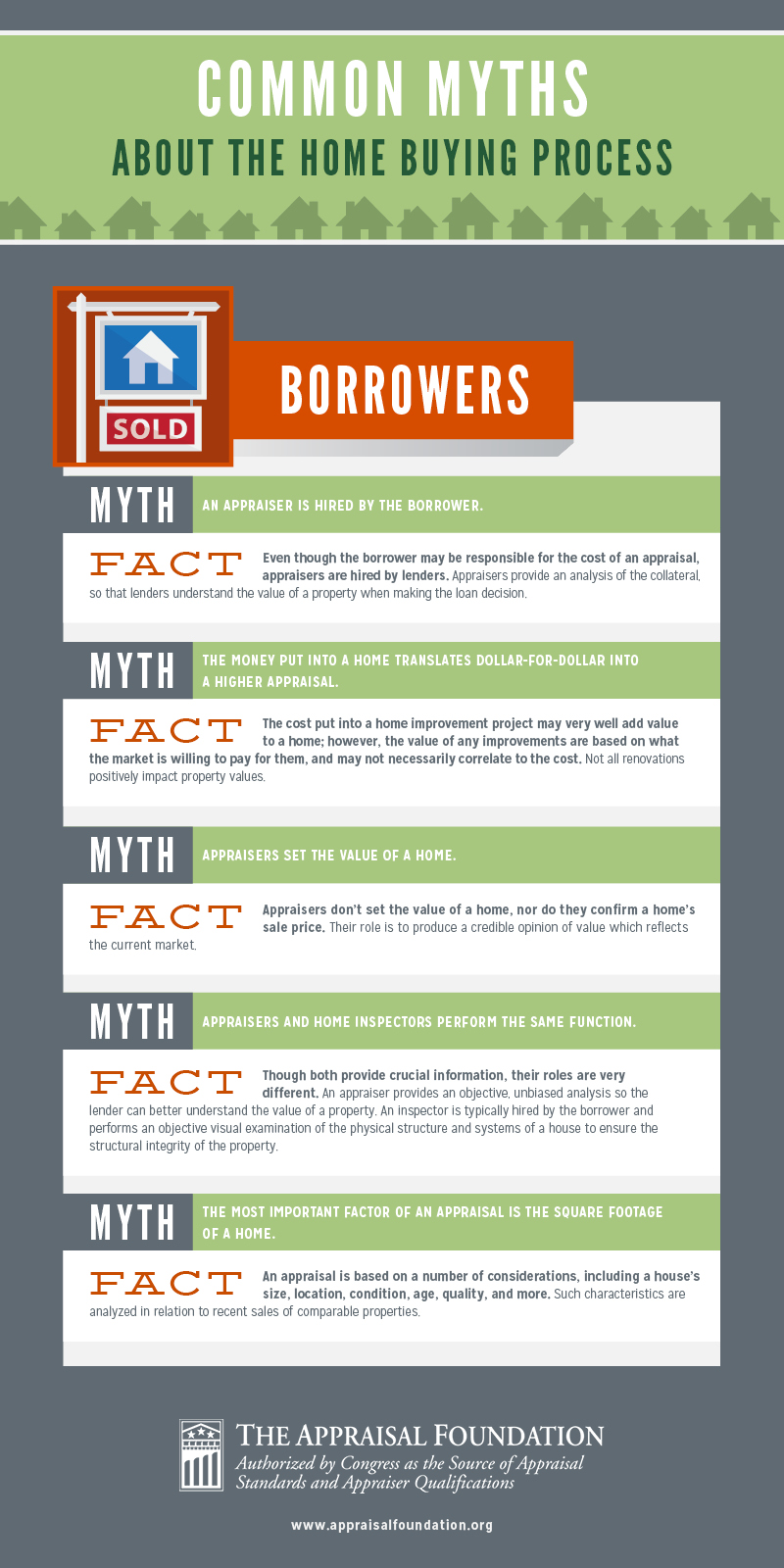

The main reason you will need an appraisal is that mortgage lenders require one before it will approve your mortgage loan. Appraisals apply to all home loans from banks that are backed by the federal government through either the Department of Veterans Affairs or the Federal Housing Administration . Typically the seller of the home pays for the home appraisal at closing; however, in some places the buyer tends to pay. Buyers who are eager to win the home when multiple bidders are present may offer to pick up the cost of the appraisal.

Relationship-based ads and online behavioral advertising help us do that. Go to IRS.gov/IdentityTheft, the IRS Identity Theft Central webpage, for information on identity theft and data security protection for taxpayers, tax professionals, and businesses. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can learn what steps you should take. You can prepare the tax return yourself, see if you qualify for free tax preparation, or hire a tax professional to prepare your return. See Form 5405, Repayment of the First-Time Homebuyer Credit, to find out how much to pay back, or if you qualify for any exceptions. If you do have to repay the credit, file Form 5405 with your tax return.

Closing cost credits

The ball’s in the seller’s court here — it’s up to you to decide if you’re willing to renegotiate the sale price so that it aligns with the appraisal outcome. Appraisals are a standard part of the home-buying process, and they protect the buyer’s lender from offering too much money for a home that isn’t worth the cost. While this may seem like a formality, in hot real estate markets, bidding wars can drive home sale prices well above the true value, which is a red flag for lenders. For example, if a homeowner is refinancing their mortgage, an appraisal is usually required.

The appraisal process takes 3 to 7 days to complete before you an close. Most home appraisals are ordered by the mortgage lender to make sure that when they loan a borrower the money needed to buy a home, the purchasing price reflects its fair value. Banks count the house as a bank asset for many years until the borrower has paid off much of the balance. Estate Appraisal Cost – An estate appraisal includes all property of worth with the sales value of the home.

Do Appraisers Look in Garages?

There are a variety of ways to get the information you need, depending on how much time and effort you are willing to put in, as well as cost if you seek professional help. Don’t forget that every state has different requirements for documents needed to sell a house, so it’s advisable to work with an agent with experience in your area. Then, the inspector drafts up a home inspection report that spans about pages in length . The document details the state of your home’s structure, the electrical system, plumbing, heating, fireplaces, etc.

Before committing to the sometimes long and expensive process of selling a home, be sure you have identified your reason for doing so. This will help you determine if you are ready to make the full commitment. Assess your current finances and determine how much equity you have in the house. Furthermore, make a list of non-negotiables that include desired time frames and minimum offers you are willing to accept. Work with your real estate agent to find accurate comparisons of recent local home sales that prove your property's value is higher.

I Found Some REALLY Gross Horror Comics...

The deed includes the identification of both parties as well as a thorough description of the property itself. Don’t forget that capital improvements do not include items necessary for the maintenance and repair of your home, only those improvements that have added to or increased your home’s value. Capital improvements are things like kitchen and bath remodels, or big additions like a swimming pool or new roof. They mitigate the capital gains taxes you owe on your home sale by adding to your adjusted cost basis. Obtaining a free mobile home value report is one way to get a quick understanding of how to price the home if you’re looking to sell.

Typically, it will be the buyer’s real estate agent who brings up the dispute with the lender. You are legally entitled to obtain the appraisal report three days before closing and can check to make sure all the information is correct. Ensure it has documented the exact square footage and number of rooms.

Find a place you’ll love to live

If you think you or a loved one may be a victim of fraud, consult with a real estate attorney before attempting to terminate a contract. Typically, the seller must give formal notice to the buyer that they’re in breach and then wait several days to see if they comply. Using the wrong tactics to get out of a sale — or cutting corners when attempting to use valid ones — could quickly land sellers in a legal minefield.

You owned a remainder interest, meaning the right to own a home in the future, and you sold that right. A separation or divorce occurred during the ownership of the home. Report as ordinary income on Form 1040, 1040-SR, or 1040-NR applicable canceled or forgiven mortgage debt.

This means nearly half of all sales had some sort of credit for repairs, closing costs, rate buydown, etc.. The housing narrative seems like a game of ping pong where glowing and dark outlooks are rallying back and forth. Some say the market is going to rebound, but then there’s concern about recent jobs numbers. Or in one breath some think rates will go down, but in the next there’s uncertainty about the Fed meeting next week. Or people are pumped about conforming loan limits increasing, but affording the market is still not doable for many buyers. A seller can only back out of a contingent offer if the purchase agreement includes a contingency that authorizes the seller to terminate the contract.

If any problems crop up during the process, an experienced professional will be there to handle them for you. Finally, agents are familiar with all the paperwork and pitfalls involved in real estate transactions and can help make sure the process goes smoothly. This means there won’t be any delays or unforeseen legal ramifications in the deal. They will help you set a fair and competitive selling price for your home, increasing your odds of a quick sale. If the buyer can’t come up with the difference but you know your home is worth more than what it appraised at, you can offer them seller financing for the difference — assuming you have enough cash. You’d essentially loan them the money, taking payments either in regular installments or in a lump sum down the road.

Explore the best home improvements for resale and how to market your fixer-upper to sell quickly. Ready to continue your homeownership journey and apply for a mortgage or a refinance of your current home loan? Get started with Rocket Mortgage® today to learn more about the next steps in the home buying or refinancing process.

Fees for an appraisal usually range between $300 to $500, but remember to do your due diligence when hiring an appraiser. An inaccurate appraisal could mean making important financial decisions concerning your home’s future using bad information. Many real estate brokers offer free online calculators to estimate the value of your home.

If you received any homebuyer credits or federal mortgage subsidies, you may have to pay back (“recapture”) some or all of the amount by increasing your tax payment. Start with the amount of real estate tax you actually paid in the year of sale. Subtract the buyer's share of real estate tax as shown in box 6. The result is the amount you can deduct as an itemized deduction. If NONE of the three bullets above is true, you don’t need to report your home sale on your tax return. If you didn’t make separate home and business calculations on your property, skip to Reporting Deductions Related to Your Home Sale, later.

Sometimes a home’s appraised value is different than the agreed-upon purchase price. A low appraisal could affect the sale of a home because the mortgage lender will not lend more than the appraised value. If this happens, it’s important to know the steps to dispute a home appraisal and your options for moving forward with the sale. If you don’t agree with an appraisal, you can ask the lender to revisit the assessment—called a Reconsideration of Value . Since the buyers paid all of the taxes, Dennis and Beth also include the $212 in the home's selling price.

No comments:

Post a Comment